For a long time, the way philanthropy worked was simple: Rich people gave their money to museums and churches and opera houses and Harvard. Their names went up on buildings, charities gave them made-up awards, their grandkids went to rehab, the Earth went around the sun.

But philanthropy is changing. Today's billionaires are less interested in legacy institutions, less obsessed with prestige and perpetuity. Part of this is a function of their age: In 2012, 4 percent of America’s biggest charitable donations were made by people under 50 years old. In 2014, a quarter of them were.

The other factor driving the new philanthropists is how they earned their money in the first place. Last year, six of the 10 largest charitable donations in the United States came from the tech sector, solidifying Silicon Valley’s place as the epicenter of the newer, bigger, disrupty-er philanthropy. There, tech billionaires form “giving circles” to share leads on promising charities, and they hire the same consultants to vet them. They use terms like “hacker philanthropy” and “effective altruism.” These guys—they are mostly guys—believe that they became successful businessmen by upending existing institutions, by scaling simple ideas, by "breaking shit." And, with few exceptions, that is how they plan to become successful philanthropists, too.

All of this became much more relevant in December, when Mark Zuckerberg and his wife, Priscilla Chan, announced that they were giving 99 percent of their wealth to charity. The total amount they pledged, around $45 billion in Facebook shares at current valuation, exceeds the endowments of the Rockefeller, Ford and Carnegie foundations combined . If Zuckerberg gives away the upper limit of what he announced in December, $1 billion per year for the next three years, he will likely become the world’s second-largest charitable donor after Bill Gates. He is 31 years old.

Zuckerberg’s ability to remake the world in his own image, in his own lifetime, is unprecedented. Andrew Carnegie opened his first library when he was 68, and only managed to get around $5 billion in today’s dollars out the door before he died. John D. Rockefeller, generally considered the most generous industrialist in history, launched his foundation when he was 76, and only gave away around half his fortune. If he wanted to, Zuckerberg could eradicate polio, or de-neglect half a dozen tropical diseases, or fix all the water pipes in Flint, or give $9,000 to every single one of the world's refugees.

But $45 billion, as a former Bill & Melinda Gates Foundation grantee put it, is "a 1,000-pound gorilla." You don't give away that much money without changing the places and institutions and people you give it to, sometimes for the worse. Zuckerberg should already know this. In 2010, he donated $100 million to the Newark Public Schools on a promise from Cory Booker that he could, according to Dale Russakoff's The Prize, "flip a whole city." Zuckerberg rode into Newark with the suddenness of a software update. He was determined to end the stalemate between the teachers’ union and the district, establish dozens of new charter schools and close down failing public ones. Oh, and establish a model that could be replicated in urban school districts all over the country. All in just five years.

Needless to say, it didn't happen. Up to $20 million of the donation went to consultants, scrappy little MBAs charging $1,000 a day to develop, among other things, an algorithm that assigned thousands of children to new schools. And nobody bothered to ask parents or teachers whether they wanted to be flipped, causing a ton of resentment that ultimately slowed everything down. By 2015, Zuckerberg was touting Newark's charter schools, with 14,000 students, as a success. Meanwhile, its public schools, with 35,000 students, were announcing a budget deficit of $65 million and layoffs of up to 30 percent of their staff.

As Antony Bugg-Levine, the CEO of the Nonprofit Finance Fund, told me, the hard part about social change “is that it doesn’t scale like a social network.”

I’ve spent the last few months talking to more than 40 researchers, development practitioners, foundation employees and other Silicon Valley philanthropists, asking them about the difficult business of giving money away. They told me about their own Newarks: Promising ideas scaled into oblivion, donations that disappeared into corrupt governments, groupthink disguised as insight. But they also told me about projects that worked, that scaled, that matched the ambitions of the new philanthropy while avoiding its blind spots. And it turns out that some of the best ideas are the ones Zuckerberg is the least likely to hear in Silicon Valley.nce December I've been studying Zuckerberg’s Facebook posts like a Talmudic scholar, looking for hints of what he's interested in, trying to figure out the investments and bets and mistakes he's going to make. So far he’s light on specifics, mostly speaking in gushy bromides about "connecting people" and "building strong communities." But if there is one clear, undeniable, overriding theme that emerges, it is this: Zuckerberg believes in the power of technology to transform the world.

"We must build technology to make change," he wrote last fall. "Many institutions invest money in these challenges, but most progress comes from productivity gains through innovation."

He's not wrong. Nearly every social advance in history has technology somewhere near the center of it—the aqueduct, the steam train, the birth control pill. And whenever you start asking people about the life-altering potential of Mark Elliot Zuckerberg and the tech-based philanthropy he represents, the first words you're likely to hear are “The Green Revolution.”

In 1975, nearly three out of five people in Asia lived on less than $1 a day. Rains at the wrong time of year meant the difference between starvation and survival. Then, researchers funded by the Ford and Rockefeller foundations created new crops—varieties that grew taller, needed less water and could be planted year-round. Over the next 30 years, this innovation radically improved the lives of hundreds of millions of people. Rice yields spiked by 1,000 percent. Wheat got cheaper, healthier and more abundant. Norman Borlaug, the scientist who developed the new wheat varieties, won the Nobel Prize.It's understandable to be seduced by this story. America spent more than 100 years going from a poor agrarian society to a rich urban one. Technology, the development agencies and the foundations tell you, has the potential to "leapfrog" this process for the next batch of countries, to boost poor communities into the middle class without all the messy slave labor and cholera we went through on the way.

But as Kentaro Toyama, a former Gates Foundation consultant and the author of Geek Heresy: Rescuing Social Change from the Cult of Technology, points out, it’s not the development of technology that leads to social change, but the application of it.

The Green Revolution, he says, wasn't just a case of "new crops, big changes." At the same time the farmers were planting the higher-yield crops, governments were dramatically reforming their agricultural policies. Between 1972 and 1990, Asian countries nearly tripled their investments in agriculture. They provided subsidized loans for farmers to buy fertilizer, trained them in how to plant the new crops and built roads and canals to get their produce to markets. In 1970, only 12 percent of the agricultural land in Bangladesh was irrigated. By 1995, 38 percent of it was.

"Technology," Toyama says, "is the easiest part of any solution." The hard part is everything that comes afterward. Take car crashes, which kill more people every year than tuberculosis or pulmonary disease. The technology to prevent these deaths—seat belts, motorcycle helmets—is not rocket science. It's just that no one has figured out how to make it appeal to the people who need it, especially in the developing world, where 90 percent of these deaths occur.

Sometimes technological solutions aren't up against indifference, but outright resistance. In the ’80s, a global health NGO called PATH got a grant to develop Uniject, a pre-filled, single-use syringe designed for midwives or birth attendants to inject patients in their homes. The syringe was ready in the mid-1990s, but more than 15 years later, it had only been rolled out in one developing country. The others had laws that prohibited anyone but doctors from giving injections. "Lots of new technologies require policy changes to be effective," says Michael Free, the former director of product development for PATH. "Getting buy-in for that takes a lot longer."

All these snags, though, are too complicated for the clean "leapfrogging" narrative you hear from the techno-utopians—and from Zuckerberg himself.

"A few months ago I learned about a farmer in Maharashtra called Ganesh," Zuckerberg wrote in an op-ed in the Times of India in December. "Last year Ganesh started using Free Basics [Facebook's no-cost Internet service for developing countries]. He found weather information to prepare for monsoon season. He looked up commodity prices to get better deals. Now Ganesh is investing in new crops and livestock."

This, too, is tempting to swallow whole. If farmers knew the prices they'd get for their produce, they could choose the market offering the highest price, or plant more profitable crops in the first place. Entire communities could be changed by the simple injection of information.

The only published evidence of this effect in the real world, though, is a 2007 study that showed fishermen in Kerala, India, checking prices for their fish before deciding which port to sell them to. These fishermen sell a perishable good. They have to sell it to someone, they have to sell it today and it's the same distance back to the shore regardless of which port they pick.

But the typical African or Indian farmer does not live perfectly equidistant from several produce markets. One might take an hour to get to, the other 10. And when farmers in developing countries buy seeds, they are not comparison-shopping between dozens of stores. They have just a few options, and often have to go through village middlemen or loan sharks.

"Even when you have the information," Toyama says, "you're not in a situation where you can get any benefit from it."

Also, when “leapfrogging” happens, it can be less of a jump and more of a step. The Kerala study, which sounds so transformative, only boosted incomes for fishermen by around 8 percent, and reduced the price of fish for consumers by 4 percent. It didn’t turn poor fishermen into white-collar workers, and it didn’t give a broad swath of the population access to more nutritious food.

And guess what? That's fine! If there's one piece of advice that emerges from the last 50 years of the tech-for-the-poor hope and disappointment cycle, it is this: Chase the 8 percents.

Zuckerberg has interest and expertise in technology, and there's nothing inherently wrong with making bets on gadgets or innovations that have the potential to help the poor. But as he does so, he should acknowledge that the silver-bullet promise of technology only works at changing the world when it's combined with political will and popular demand. Until he finds a way to engineer those (please don't), he should focus on the small ways, at the margins, where technology can improve people's lives, 8 percent at a time.

In 2001, the Gates Foundation gave PATH and the World Health Organization $70 million, 10 years and a simple objective: Develop a vaccine for meningitis A and make it affordable for every single person who needs it.

At the time, meningitis A was concentrated in one part of the world, a stripe across the middle of sub-Saharan Africa known as the "meningitis belt." The disease mostly affected children, causing them to die or become paralyzed in minutes. The yearly outbreaks were predictable. Where they would happen, and how severely, were not.

Eventually, PATH developed a vaccine that gave patients 15 years of immunity. At a cost of around 50 cents a dose, public health departments in every country in the meningitis belt could afford to procure it at scale. By 2013, less than a decade after an outbreak killed 25,000 people, the meningitis belt had just four reported cases.

Marc LaForce headed the team in charge of bringing the vaccine to market. He says it wasn't just the scale of the Gates donation that mattered, but its duration. In those days, most grants were capped at two or three years, with check-ins every six months. Years of work could be wiped away if a donor decided progress was moving too slowly and pulled out.

"If you want to do something major," LaForce says, "you need the ability to go two steps forward, then one step back."

Plus, the Gates team left LaForce alone. Back then, the foundation only employed about a dozen people who worked out of a small office in a residential neighborhood of Seattle. Staffers spent their time making lists of diseases, ranking them by annual fatalities, then calling around to find out which ones were closest to being cured.

“We didn’t need to be specialists,” says Gordon Perkin, the foundation’s first director of global health. “We just needed to know which organizations had the judgment and the infrastructure, and we gave them money.”

This story doesn't just illustrate the potential of philanthropy. It also demonstrates that how Zuckerberg gives away his money will be just as important as what he gives it to. Because one way to look at his $45 billion is that it's a lot of money. Another way to look at it is that it's about what the United States spends on prisons every six months. Or education every four weeks. Or health care every five days. Even at a scale that large, efficiency matters.

It’s shocking just how unusual that early Gates grant was. Most legacy foundations pay consultants millions of dollars to study and re-study problems before they give grants toward solving them. The Ford Foundation spends nearly $1 for every $4 it gives away. In 2013, the Rockefeller Foundation’s largest grant recipient (other than its offshoot, Rockefeller Philanthropy Advisors), was Dalberg Global Development Advisors, a consulting firm.

“All the work was to provide advice on internal decision-making,” a former Rockefeller employee told me. “To make it seem charitable we'd ask them to write a blog on our website, and that would frequently be the only public or charitable thing to come out of these multimillion-dollar so-called grants.” (In a statement, the Rockefeller Foundation defended its approach, saying that it “has developed a rigorous model on how to determine the problems we support, and ultimately the solutions that we believe will create the most impact.”)The Gates Foundation, as it's expanded to more than 1,300 employees, has become prone to the same bloat, the same "expert-itis," as a former grantee calls it. "They hired Ph.D.s in biotech and all they wanted to do was the science that the grantees were doing."

As the staff proliferated, so did the conditions on the donations. The foundation started requiring grantees to keep track of baggage fees and told them they couldn't buy laptops or let their overhead go above 15 percent. "Grant approval processes went from 48 hours to 48 months," the former grantee told me. (The Gates Foundation responded, too: “While each grant agreement is unique, we have policies in place to help ensure that our funds are spent as effectively as possible.")

It’s hard to overstate just how un-Silicon Valley all of this is. "Money is sitting there to make the world a better place, and to dole it out cautiously is antithetical to why it’s there," says Freada Kapor Klein, a partner at the Kapor Center for Social Impact, a foundation set up by Mitch Kapor, an early investor in Uber and other unicorns.

I heard similar arguments from almost all the tech people I talked to: Zuckerberg shouldn't be afraid to fail; he should approach philanthropy like a venture capitalist, testing out ideas to scale up later on. Bypassing legacy institutions is what Silicon Valley CEOs are good at, right? All those consultants must strike them as the charity equivalent of taxi medallions.

Still, running a charity does require fully understanding problems before you try to solve them. "Move fast and break things" is a fine mentality for Facebook, where the consequences of a few bad lines of code are mostly limited to a drop in revenue or an exodus of users to Snapchat. Applying the same philosophy to health or education or criminal justice has consequences that can't be shrugged away. In the 1990s, Western donors' emphasis on HIV/AIDS in Africa resulted in chronic under-funding of less-visible conditions like pneumonia, anemia and diarrhea. Zuckerberg's donation in Newark resulted in public schools being closed and some kids having to walk through rough neighborhoods to charter schools far from their homes.

And it’s this neglected zone, somewhere between bloat and "break things," where Zuckerberg has the opportunity to do something quietly, unsexily awesome. The U.S. has more than 85,000 foundations and 1.5 million charities. Most major charitable causes, things like curing cancer, regularizing immigration and providing early education, are already covered by dozens of capable—and overlapping—organizations. In its annual survey of philanthropists, Grantmakers for Effective Organizations reported that 80 percent of donors wanted to see more collaboration between their grantees. But only 13 percent were willing to consistently pay for it.

The need for coordination is obvious when you look at the scale of the problems that philanthropists want to solve. Again, studying Gates’ early years is instructive. When he decided he wanted to vaccinate hundreds of millions of African kids, he didn't set up an organization that would replace WHO or UNICEF or all the other agencies already handing out vaccines. Instead, he founded something called Gavi, the Vaccine Alliance—a funding pipeline designed to help those agencies work more effectively. Gavi pays pharmaceutical companies to research tropical diseases, it issues "vaccine bonds" so poor countries can buy millions of treatments on layaway, it orders medications in such bulk that the cost comes down to pennies. In short, it connects a network of actors who have similar interests—something Zuckerberg knows a thing or two about.

So if he really wants to leverage the limited funding he has, Zuckerberg shouldn't think of himself as a venture capitalist. He should think of himself as a mutual fund manager. Find promising organizations, perform due diligence, link them to a portfolio of other agencies doing good work—then give them money and get out of their way.

Or, as Patricia Stonesifer, the current CEO of Martha's Table and the former CEO of the Gates Foundation, puts it, “Don’t expect to be the only solution out there.”

What Zuckerberg actually announced last December wasn't a big fat donation to charity. All he did was establish a limited liability company (LLC) and issue a promise that he would use it for good. Much of the reaction at the time was suspicious, speculating that an LLC was a scheme for Zuckerberg to avoid taxes (which isn't true) or that it would allow him to spend mountains of money without disclosing how he was doing so (which is).

But the corporate approach actually makes a lot of sense. Under the standard philanthropic model, billionaires set up a foundation and give it a huge endowment. Every year, the foundation has to give away at least 5 percent of its total value. Meanwhile, the other 95 percent gets invested in blue chip stocks, hedge funds, foreign currencies, whatever will keep the total endowment the same size. That's how foundations like Rockefeller and Ford exist in perpetuity: Do-gooders work on one side of the building finding things to donate to, while bankers work on the other side, making sure there's more to donate next year.

Recently, though, donors have started to reject this model. Giving away a trickle of money each year is unlikely to live up to the verbs—transform, reimagine, revolutionize—the new philanthropists use to describe their goals. Besides, why should 95 percent of your money just sit there in hedge funds and Halliburton stock, especially if you think you can do just as much good with the money you invest as the money you give away?

"This idea that philanthropy is only about nonprofits is an outdated model," says Paula Goldman, a vice president at the Omidyar Network. Pierre Omidyar, the founder of eBay, was one of the most prominent tech billionaires to merge his investing and grant-making. The foundation still gives donations, but the LLC provides loans and seed capital and invests in things like solar-powered lighting startups, Brazilian test-prep companies and funds that discover Indian entrepreneurs.

Zuckerberg is going even further, giving up on a foundation entirely and putting all of his charity money in a corporate form with no limits on how to spend it. He’s not interested in making his money back. He just wants the flexibility to fund charities or companies or both. Which explains why one of Zuckerberg’s most recent donations wasn’t a donation at all. It was $10 million in seed capital for an education startup called Bridge International Academies, a chain of private elementary schools that wants to deliver education to the world's poorest students.

Bridge’s model, which has only been rolled out in Kenya so far, is based on standardization and accountability. Teachers get a centralized curriculum from Bridge experts, then deliver it to kids from an e-reader. Students—and teachers—are tracked in real time, principals notified of everything from attendance rates to busted pipes. The first set of students educated at Bridge for all six years of primary school just took their exams. Sixty percent passed, compared to the national average of 49 percent.

It's tempting to say capitalism perverts philanthropy, full stop, and advise Zuckerberg to go back and form a foundation. But that's not right either.

The primary appeal of Bridge, especially to investors like Zuckerberg, is the $6 per month it says it charges its students. Operating as a business rather than a charity gives each school an incentive to deliver a decent education and ensures that it’s not going to wither away when development agencies or donors move on to the next idea.

But the problem with dispatching private companies to supply basic services is that they replace the public systems already tasked with providing them. Last year, 116 African NGOs signed an open letter to Bridge International Academies and the World Bank, pointing out that $6 per month is in fact a lot of money for a lot of Kenyans. Bridge schools charge extra for uniforms, for lunch, for after-school tutoring. Its teachers earn around $90 per month, teaching classes as large as 70 students.

Those pass rates 11 percent higher than the national average are great, but the letter also noted that Bridge, with 400 schools, has attracted more than $100 million in international investment. Meanwhile, Kenya's public system, with almost 20,000 schools, has gotten just $88 million.

Lucy Bradlow, Bridge's global director of public relations, counters that the majority of Kenyan kids already attend private schools, many of which cost even more than Bridge and provide even less. In public schools, teacher absentee rates are so high that the average kid only gets two hours of instruction per day.

She’s right: Bridge is a little bit better than what's already there. But the troubling part about the company isn't the service it provides now, but the one it wants to provide later. Bridge sees itself as a “model,” one that its backers believe can be spread across the entire developing world. It plans to be profitable once it serves 500,000 students. Eventually, it hopes to reach 10 million. Bridge's own marketing materials describe it as “a scalable Academy-in-a-Box solution.”

But the history of philanthropy is littered with projects that helped the poor at a small scale, then made them worse off at a larger one. Microfinance started out small, too. The early trials were non-profit, and revenues were invested back into services that would help borrowers pay back their loans. Then, in the late 2000s, responding to donor pressure to be “sustainable,” microlending went private. Citibank, Barclays and Deutsche Bank established microfinance divisions. In 2007, one of the largest microlending banks, Mexico’s Compartamos Banco, even had an IPO, its executives earning millions loaning out money to women and poor farmers and charging interest rates as high as 195 percent.

Since most loans were capped at a few hundred dollars, borrowers could only get enough money to set up informal businesses, stuff like selling fruit on the side of the road or giving rides on a scooter. As microloans flooded the market, small-scale services flooded entire economies. In Bangladesh, nearly 25 percent of the population took out a microloan. In Mexico, Compartamos’ customers were taking out new microloans to pay back the ones they already had. By scaling up too fast, microfinance ended up trapping people in the exact cycle—informal work, bottomless debt, low productivity—from which it was designed to free them.

It's tempting to stop there, to say capitalism perverts philanthropy, full stop, and advise Zuckerberg to just go back and form a foundation. But that's not right either. One of the most successful private-sector development projects of the last 10 years is M-PESA, the mobile-money system that allows people in Kenya to transfer money via their cell phones. Before the system launched, Kenyans sent money to each other by mail, or by giving envelopes full of cash to bus drivers. Replacing an inefficient, expensive system with a regularized one made everybody better off. That's not as easy to argue, in the long run, about education.

So, when Zuckerberg hears pitches from companies seeking to solve the world's problems, he shouldn't ask them if they have a plan to grow, or an ambition to exist in perpetuity. He should ask himself whether he really wants them to replace the systems that already exist, or simply make them better. Because successful companies don't just disrupt other companies—they disrupt economies, governments and the people who depend on them. That's not something that Zuckerberg ever had to worry about, but he has to start.

In 2009, four grad students came up with an audacious idea: Instead of giving poor people the things we think they need—bags of food, stacks of clothing, a pair of goats—what if we gave them enough money to decide for themselves?

They called their charity GiveDirectly, and in 2011 they started doing exactly that. They went to villages in Kenya, found the poorest people living there and transferred $1,000 straight to their cell phones. Later, they came back to ask the villagers what they did with the money. Mostly, it turns out, the villagers spent it on better roofs, better food, paying off debts, starting up businesses. All the stuff the development system used to buy for them—but without any overhead.

At first, no one wanted to fund an idea this outlandish. But then, GiveDirectly went to Silicon Valley. Google got in early, awarding the charity its Global Impact Award and dispatching the head of Google.org to sit on GiveDirectly’s board. Since then, GiveDirectly has grown like a Y Combinator startup, its budget ballooning from $700,000 in 2012 to $17.4 million in 2014. In 2013, Chris Hughes, Zuckerberg’s Harvard roommate and Facebook co-founder, hosted a coming-out party for the charity with the heads of Dropbox and General Catalyst Partners. Dustin Moskovitz, Zuckerberg's other Harvard roommate and Facebook co-founder, just handed GiveDirectly $25 million. At five years old, GiveDirectly is the most buzzed-about charity in Silicon Valley.

What all this hype ignores, though, is that GiveDirectly's audacious idea has been around for decades. Post-disaster charities have been experimenting with cash transfers since the 1990s. In 2010, when floods deluged one-third of Pakistan, aid workers handed out 1.7 million debit cards pre-loaded with $230. As early as the 1980s, Latin American countries were handing out "conditional" cash grants, paying parents to send their kids to school or feed them balanced meals. Even the World Bank, not exactly a laboratory of revolutionary thinking, has poured more than $25 billion into "social safety nets"—unemployment and pension benefits, basically—in developing countries. "Welfare" sounds a lot less “break shit” than transferring money to people via their cell phones, but it is, sorry everybody, the same thing.

And that's exactly why Zuckerberg should be excited about giving money directly to poor people: Not because it is a new and revolutionary idea, but because it is an old and effective one—that’s only fulfilling a fraction of its potential.

The challenge with direct cash payments, says Owen Barder, the director of Europe for the Center for Global Development, is getting them to all of the people who need them. The places where this strategy has worked well already had functioning banking sectors and national identification systems in place before a disaster struck. In Pakistan, humanitarian agencies used government data to identify the areas with the worst damage, then checked IDs to make sure the debit cards got to the people living there.

Most poor countries, though, don't have these pipes laid down. Kenya's Hunger Safety Nets program, which gives cash to people at risk of starvation, took months to establish because payouts were distributed through local agents, whom people didn't trust, or ATMs, which people had never used before.

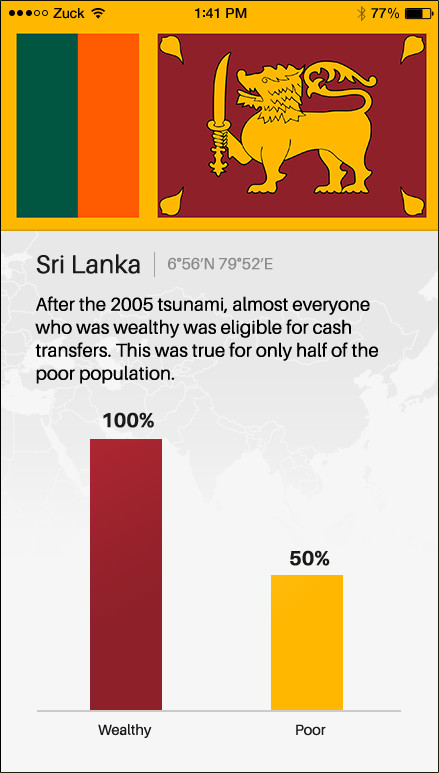

Barder describes a scenario where, 10 minutes after an earthquake hits Nepal, all the people within five miles of the epicenter get $500 on their cell phones. That's a great idea. But it is, he says, a lot harder than it sounds. After the 2005 tsunami, low-caste populations in India were almost entirely excluded from cash transfers because they weren't registered in the national welfare system. In Indonesia, cash transfers were distributed through community leaders who had to come to a central planning center, then travel back to their constituencies with an envelope full of cash. In at least one case, bandits were waiting for them on the bus.

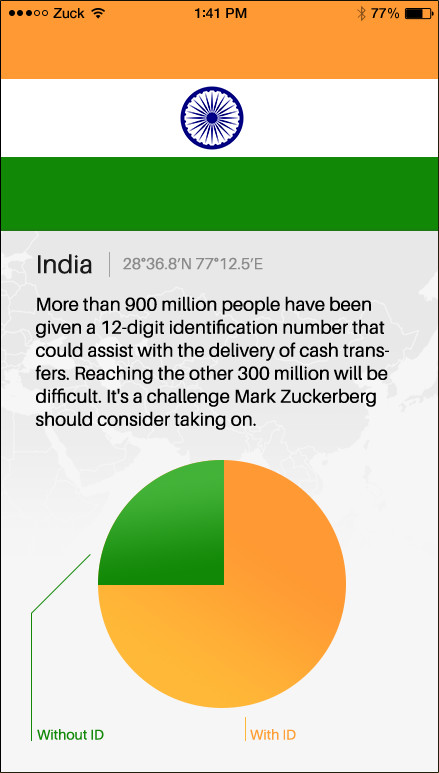

The need for modernizing these systems is obvious. In 2009, India launched an ambitious—and largely unheralded—project to issue a 12-digit identification number to all 1.3 billion of its citizens. So far, it has spent around $880 million and registered 970 million people. The numbers are already being used to distribute unemployment checks and disaster relief. But as this effort moves to more remote populations, registering them gets harder. Some farmers have hands so worn the scanners can’t read their fingerprints.

Laying down the pipes to get cash transfers to the first 75 percent of a population, the people who have birth certificates and cell phones, is relatively easy. Getting to the last 25 percent, the people one charity could never reach, is technical, slow, expensive and absolutely critical—a perfect project for Zuckerberg.

These aren't, of course, the only ideas I heard for how Zuckerberg should give away his money. Charles Kenny of the Center for Global Development says Zuckerberg should invest in global public goods, things no single government wants to pay for but the world needs nonetheless—like a vaccine for malaria, or making renewables cheaper than fossil fuels. Hauke Hillebrandt of the Centre For Effective Altruism says Zuckerberg should prevent "global public bads" like international pandemics or aggressive artificial intelligence—Skynet, basically.

In the end, though, Zuckerberg’s greatest impact might be in the model he sets for other philanthropists. The Giving Pledge, which encourages billionaires to donate the majority of their wealth to charity, has attracted more than 142 commitments totaling more than $400 billion. The Founders Pledge has convinced 151 startup executives—most of them look about 19—to devote a portion of their exits to philanthropy. Charitable giving in the United States has nearly quintupled since 1994, and shows no signs of reverting back to opera houses and Harvard.

Zuckerberg’s money alone is not enough to change the world, but his influence on this generation of givers might be enough to change philanthropy. If he’s successful, he’ll show them the value of going slowly. He'll hire people who come from the places he is trying to save and who have been affected by the problems he's trying to solve. He will ignore NGOs that promise to "flip" anything, and he will distrust anyone whose Twitter bio includes the words “thought leader.”

If Zuckerberg really wants to get ambitious, he should challenge the Silicon Valley notion that giving money away is an activity unrelated to how it is earned. Last year, Travis Kalanick, the CEO of Uber, started allowing users to add a $5 donation to their ride for No Kid Hungry. In the UK, the company urged riders to donate old clothes to Save the Children. Kalanick would have a better impact on the planet if he stopped asking us for our clothes and, instead, started allowing his workers to unionize. Similarly, one of Zuckerberg's values for his philanthropy is “empowering communities.” He does the opposite when Facebook turns its data over to dictators. Now that the Giving Pledge is off and running, why not establish a Stop Routing Your Profits Through Tax Havens Pledge?

I know, I know, he's running a public company. Shareholder pressure, quarterly returns, impact on innovation, blah blah blah. But perhaps Zuckerberg should ask himself why it is impossible, as a CEO, to apply the same values he aims to embody as a philanthropist. If he really wants to change the world, Zuckerberg can start by changing his own.

Story by Michael Hobbes

http://highline.huffingtonpost.com/articles/en/how-to-give-away-45-billion/

No comments :

Post a Comment